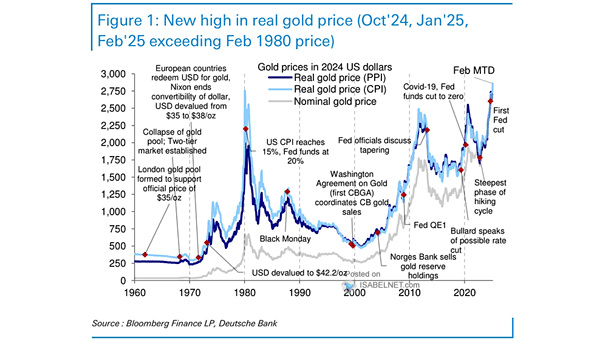

Gold Prices in 2024 U.S. Dollars

Gold Prices in 2024 U.S. Dollars The real (inflation-adjusted) price of gold has reached a new all-time high, driven by several factors including U.S. tariff uncertainties, geopolitical tensions, and increased demand from global central banks. Image: Deutsche Bank