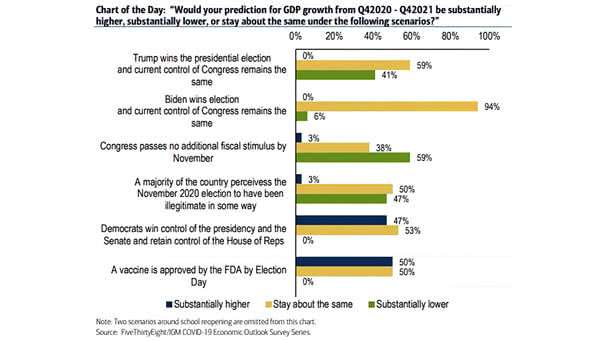

Prediction for U.S. GDP Growth from Q42020 to Q42021

Prediction for U.S. GDP Growth from Q42020 to Q42021 32 leading academic economists do not see significantly higher GDP growth under Donald Trump or Joe Biden, as long as the current control of Congress remains the same. Image: BofA