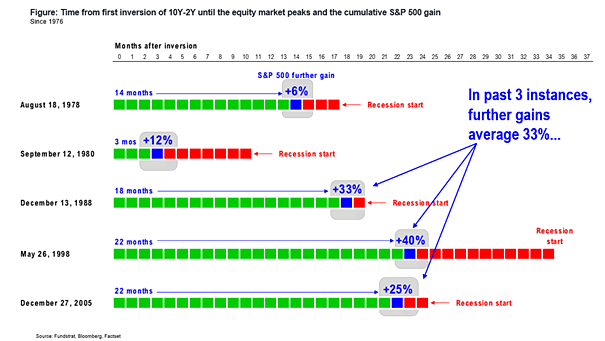

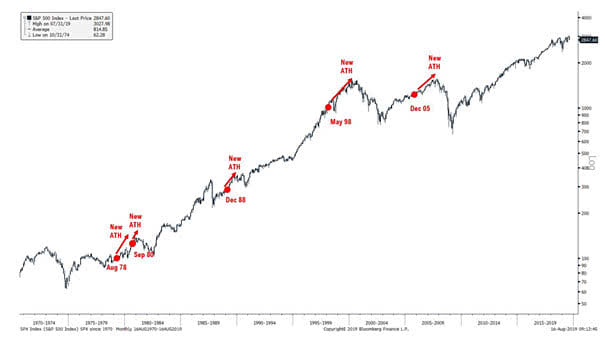

Time From First 10Y-2Y Yield Curve Inversion And S&P 500 Returns

Time From First 10Y-2Y Yield Curve Inversion And S&P 500 Returns The S&P 500 tends to rise after an inverted yield curve. Last three 10Y-2Y curve inversions, further gains average 33%. Image: Fundstrat Global Advisors, LLC