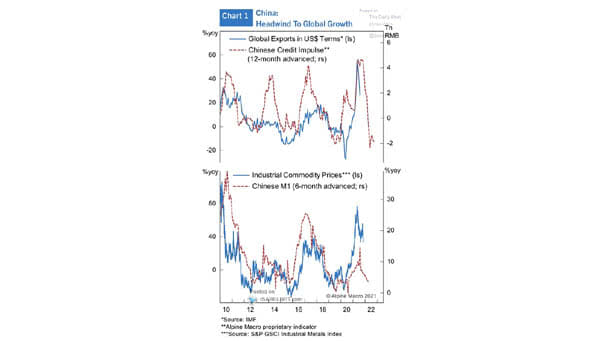

China Credit Impulse and Global Exports, China M1 and Industrial Commodity Prices (Leading Indicators)

China Credit Impulse and Global Exports, China M1 and Industrial Commodity Prices (Leading Indicators) China credit impulse tends to lead global exports by 12 months. Image: Alpine Macro