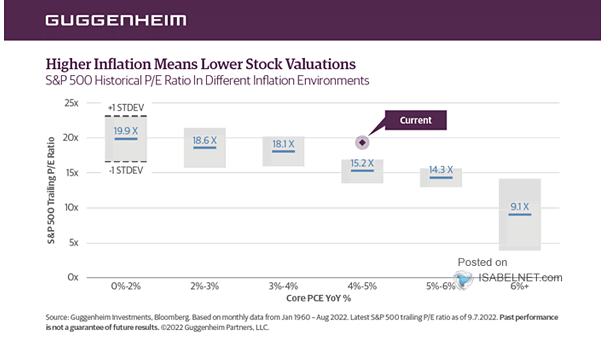

Valuation – S&P 500 Historical P/E Ratio in Different Inflation Environments

Valuation – S&P 500 Historical P/E Ratio in Different Inflation Environments Should U.S. equity investors expect lower stock valuations, as U.S. core PCE remains elevated? Image: Guggenheim Partners