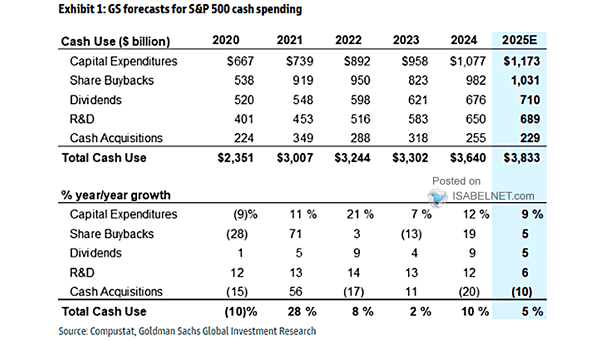

S&P 500 Cash Spending

S&P 500 Cash Spending In 2025, S&P 500 share buybacks are forecast to remain elevated, supported by solid earnings and strong balance sheets, with total repurchases anticipated to exceed $1 trillion. Image: Goldman Sachs Global Investment Research