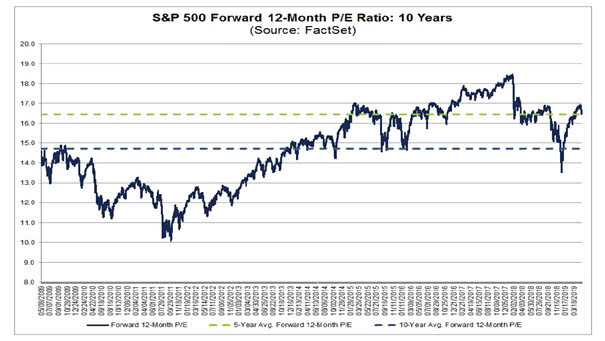

S&P 500 Valuation – Forward P/E Ratio – May 10, 2019

S&P 500 Valuation – Forward P/E Ratio – May 10, 2019 S&P 500 Valuation: Forward P/E Ratio is 16.5 and equal to the 5-year average, above the 10-Year average (14.7).Based on the forward P/E ratio, the US stock market is not too expensive. You may also like our “Stock Market Valuation.” Image: FactSet Research Systems Inc.