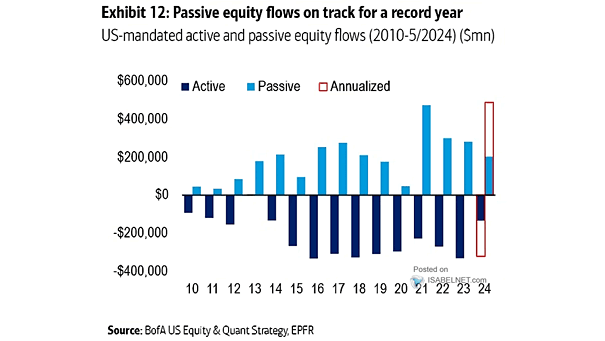

Flows by Year into Active vs. Passive Funds

Flows by Year into Active vs. Passive Funds Passive funds are growing in popularity as investors prioritize lower fees, potential tax advantages, and doubt active fund managers’ ability to consistently outperform the market. As a result, active funds are facing capital outflows. Image: BofA US Equity & Quant Strategy