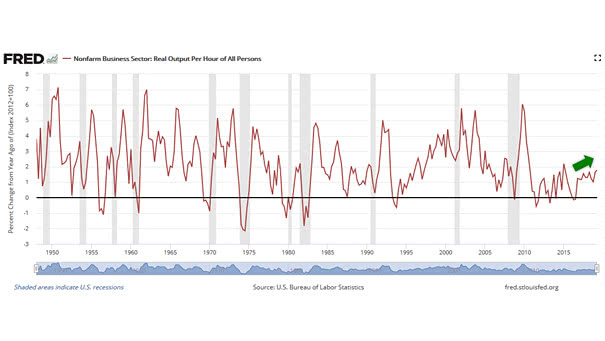

Does U.S. Productivity Increase Under Trump?

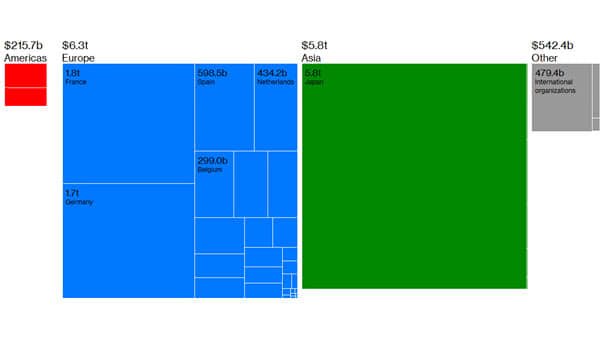

Does U.S. Productivity Increase Under President Trump? The answer is yes, because businesses have invested. Even if Net Domestic Investment to GDP is in a long-term downtrend, that’s good news for the U.S. economy. Keep in mind that it is a key factor in extending the business cycle. US Productivity has increased, because US companies have invested,…