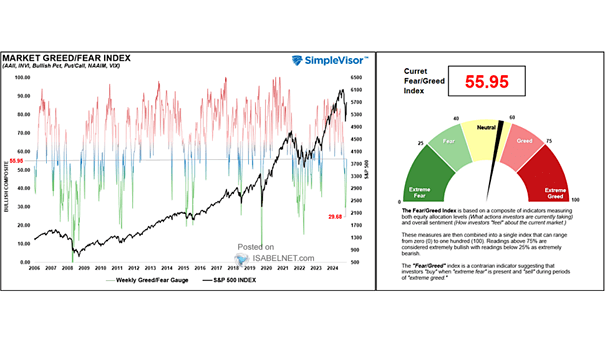

Investor Sentiment – U.S. Market Greed/Fear Index

Investor Sentiment – U.S. Market Greed/Fear Index The Market Greed/Fear Index stands at 60.07, which is now far from extreme greed territory, indicating a more neutral sentiment in the market. Image: Real Investment Advice