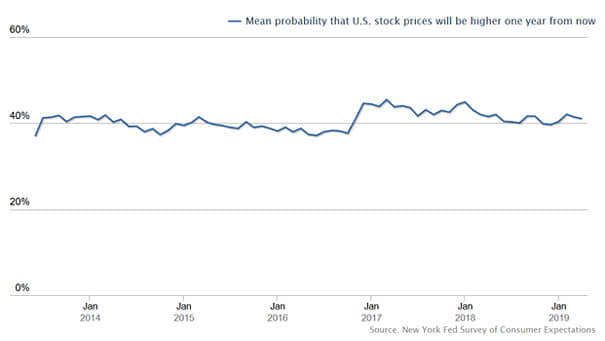

Mean Probability That U.S. Stock Prices Will Be Higher One Year From Now

Mean Probability That U.S. Stock Prices Will Be Higher One Year From Now – Survey of Consumer Expectations – The mean probability that U.S. stock prices will be higher one year from now is 41.03% as of April 2019. Image: New York Fed Survey of Consumer