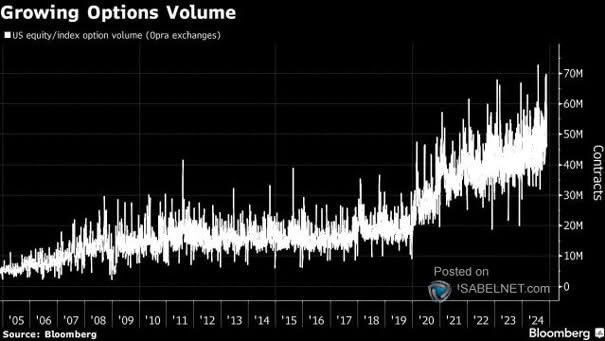

U.S. Equity Index Option Volume

U.S. Equity Index Option Volume As Trump prepares for his second term, the combination of his policy direction and the prevailing market conditions is poised to boost the options market, particularly among retail investors. Image: Bloomberg