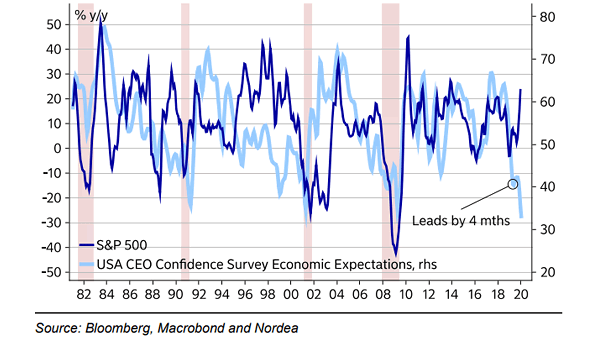

S&P 500 vs. U.S. CEO Confidence Survey Economic Expectations

S&P 500 vs. U.S. CEO Confidence Survey Economic Expectations The S&P 500 is in “Fear of Missing Out” mode, while CEO confidence has fallen to its lowest level in a decade. Image: Nordea and Macrobond