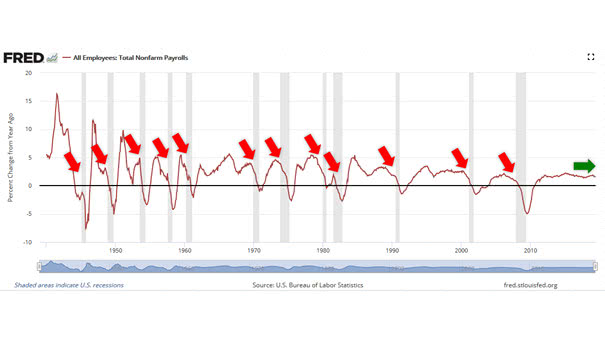

U.S. Total Nonfarm Payrolls and Recessions

U.S. Total Nonfarm Payrolls and Recessions Total nonfarm payrolls increased 224K in June, well above expectations, which should calm fears of a near-term recession. The job market is still strong, even if there are signs it is slowing down. Actually, nonfarm payroll growth tends to decline before a recession. You may also like “What Is…