Valuation – 12-Month Forward P/E Premium (Discount) of Growth vs. Value

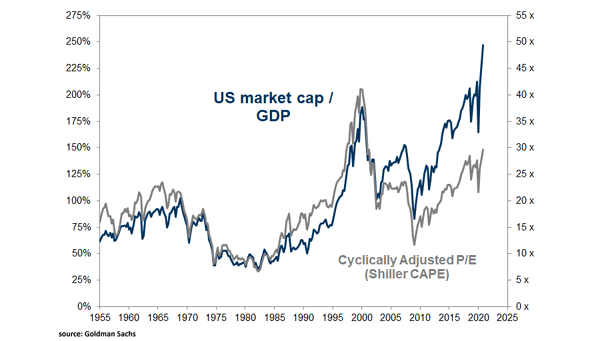

Valuation – 12-Month Forward P/E Premium (Discount) of Growth vs. Value Should investors favor value vs. growth, as the premium of growth companies reached all-time highs? Image: Goldman Sachs Global Investment Research