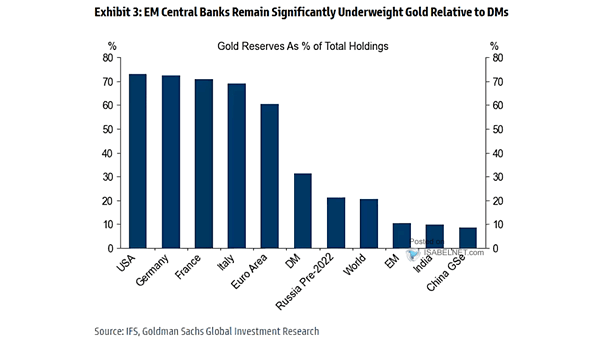

Gold Reserves As % of Total Holdings

Gold Reserves As % of Total Holdings Emerging market central banks continue to hold significantly less gold than their developed counterparts, suggesting a potential for increased future allocations that could provide sustained support for gold prices. Image: Goldman Sachs Global Investment Research