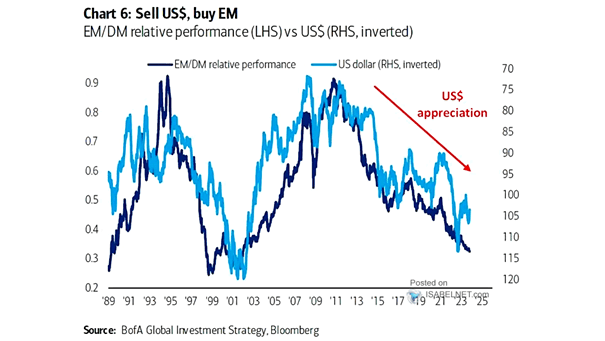

EM/DM Relative Performance vs. U.S. Dollar

EM/DM Relative Performance vs. U.S. Dollar The strength of the U.S. dollar can affect the relative performance of EM/DM equities. A weak U.S. dollar has historically led to outperformance of emerging market equities. Image: BofA Global Investment Strategy