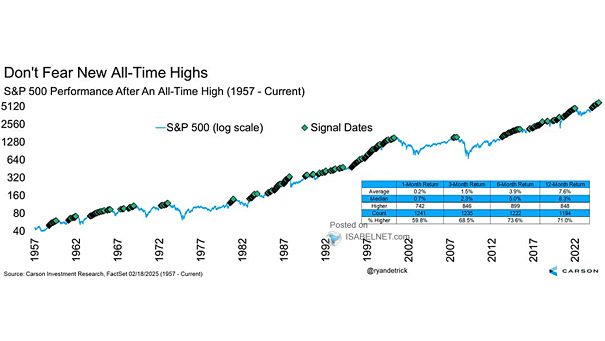

S&P 500 Performance After an All-Time High

S&P 500 Performance After an All-Time High Good news for bulls! Historically, the S&P 500 tends to continue its upward trajectory after hitting new all-time highs. Since 1957, it has gained a median of 8.3% in the following 12 months, with positive returns 71% of the time. Image: Carson Investment Research