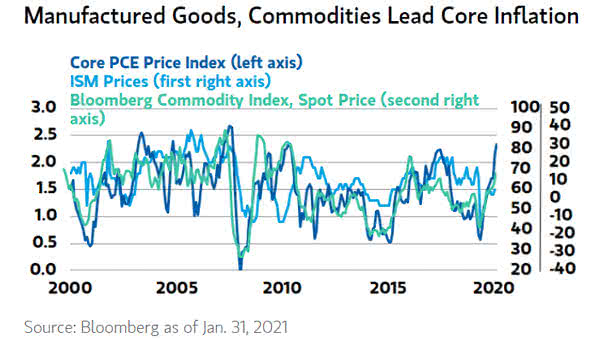

Inflation – U.S. ISM Services Prices vs. Super Core PCE

Inflation – U.S. ISM Services Prices vs. Super Core PCE History shows the U.S. ISM Services Prices Index tends to lead super core inflation by five months, which means sticky prices aren’t going anywhere soon. Image: Deutsche Bank