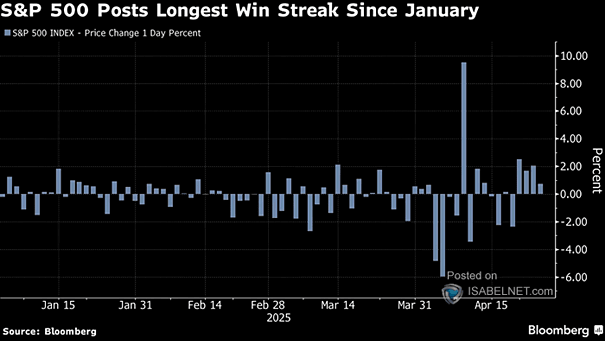

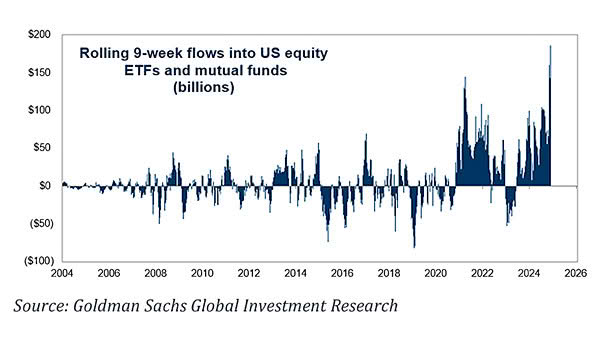

S&P 500 Index

S&P 500 Index The S&P 500 has spent much of the last 12 months trailing international benchmarks, something investors don’t see often. But should the U.S. dollar find its footing, the advantage enjoyed by emerging and foreign markets may not last. Image: Bloomberg