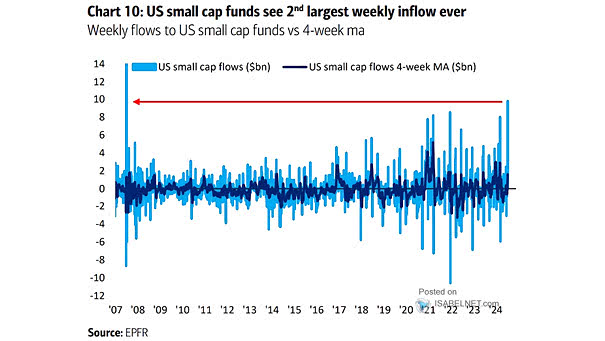

U.S. Small Cap Fund Flows

U.S. Small Cap Fund Flows The recent surge in inflows to U.S. small-cap funds highlights a favorable outlook on small-cap stocks as an investment option, as investors appear to be reallocating some of their assets toward this market segment. Image: BofA Global Investment Strategy