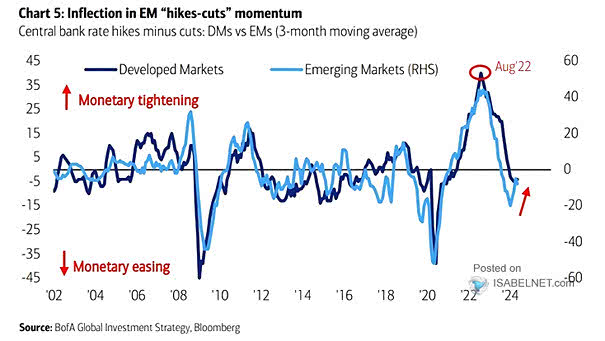

Interest Rates – Central Bank Policy Rate Hikes vs. Cuts

Interest Rates – Central Bank Policy Rate Hikes vs. Cuts Emerging market central banks typically take the lead in initiating monetary tightening and easing cycles. In 2024, their approach has shifted away from aggressive easing. Image: BofA Global Investment Strategy