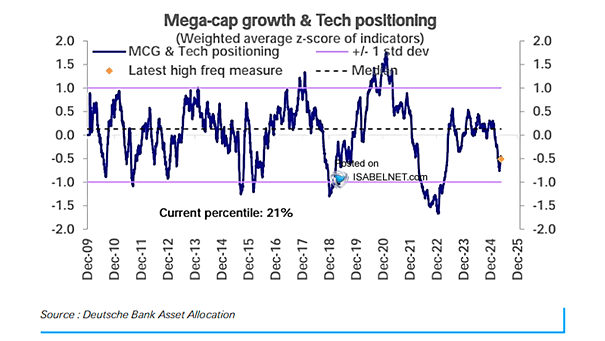

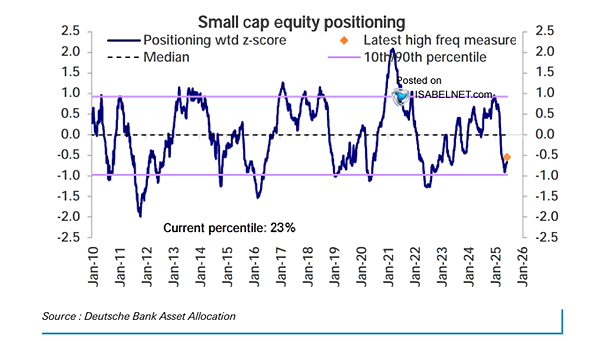

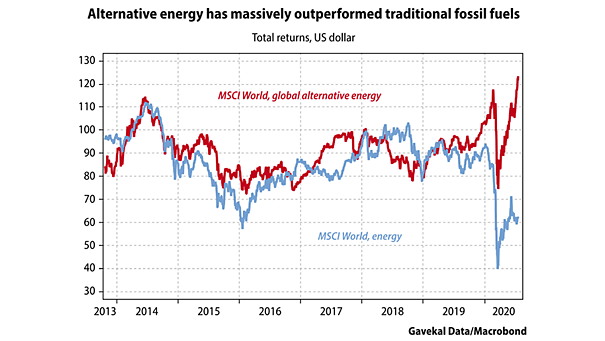

Mega-Cap Growth & Tech Positioning

Mega-Cap Growth & Tech Positioning At the 57th percentile, positioning points to a market that has gone neutral on mega-cap growth and tech, far from either exuberance or despair. Image: Deutsche Bank Asset Allocation