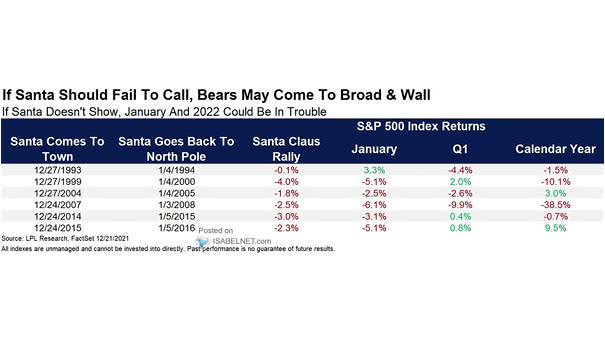

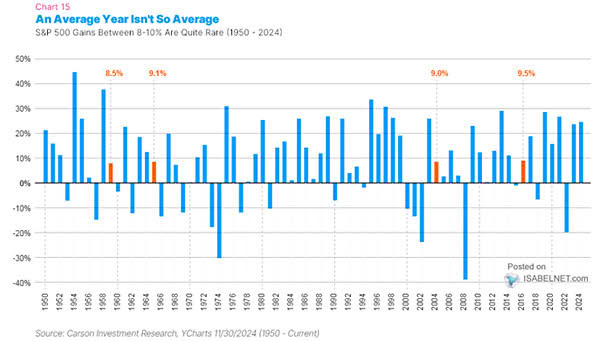

S&P 500 Index Returns and Santa Claus Rally

S&P 500 Index Returns and Santa Claus Rally Santa Claus skipped Wall Street this year, and for the bulls, that’s often a warning the new year may bring choppier trading. Will this time be any different? Image: Carson Investment Research