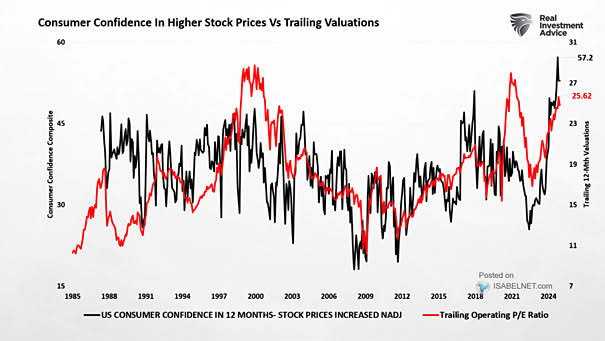

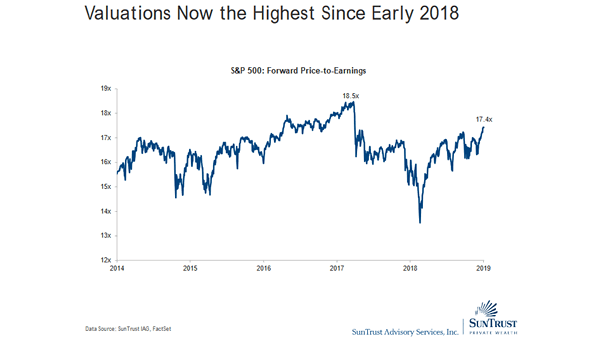

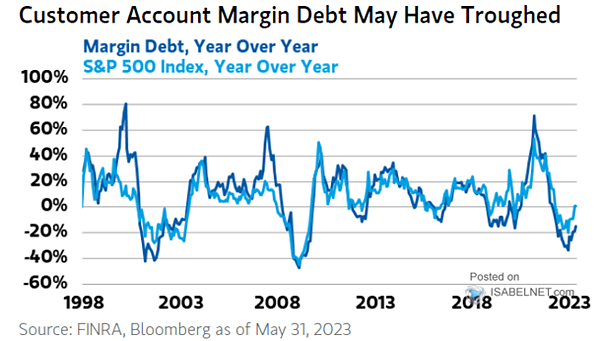

U.S. Consumer Confidence in Higher Stock Prices vs. S&P 500 Trailing Valuations

U.S. Consumer Confidence in Higher Stock Prices vs. S&P 500 Trailing Valuations Confidence in future stock gains is fueling higher valuations, with investors paying up for growth they believe will last. But that conviction could prove fragile if those expectations falter. Image: Real Investment Advice