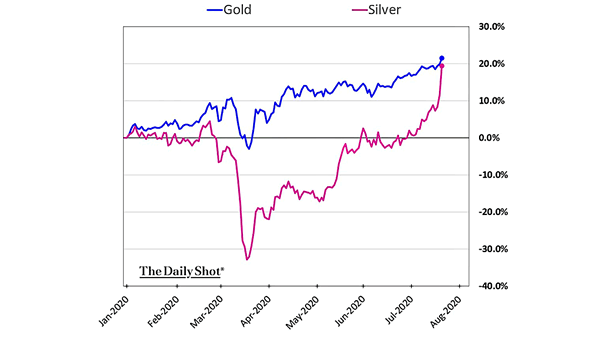

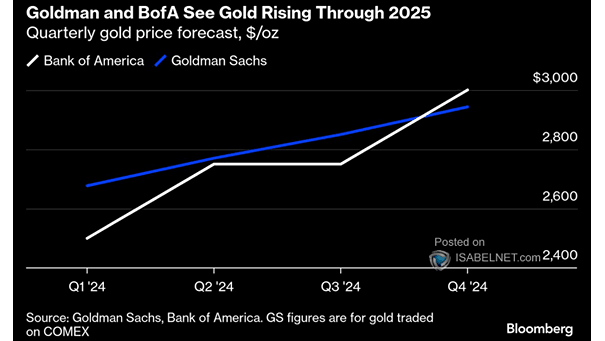

Performance – S&P 500 Total Return Index vs. Spot Gold vs. Spot Silver

Performance – S&P 500 Total Return Index vs. Spot Gold vs. Spot Silver U.S. stocks are rising, but metals are shining brighter. Gold, and even more so silver, have surged since the precious-metals move accelerated, leaving equities lagging as investors tilt toward hard assets. Image: Bloomberg