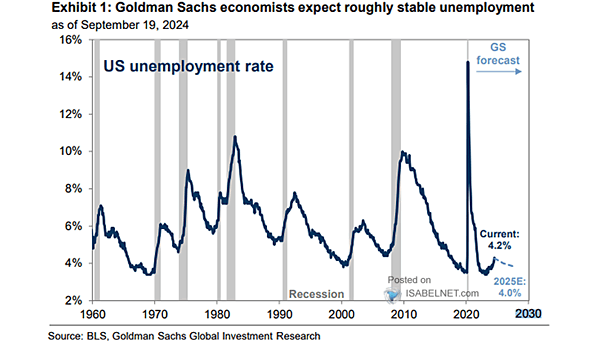

U.S. Unemployment Rate and U.S. Heavy Trucks Sales (Leading Indicator)

U.S. Unemployment Rate and U.S. Heavy Trucks Sales (Leading Indicator) Sales of U.S. heavy trucks tend to lead the economic cycle. When they drop, unemployment usually starts rising about six months later. Image: Goldman Sachs Global Investment Research