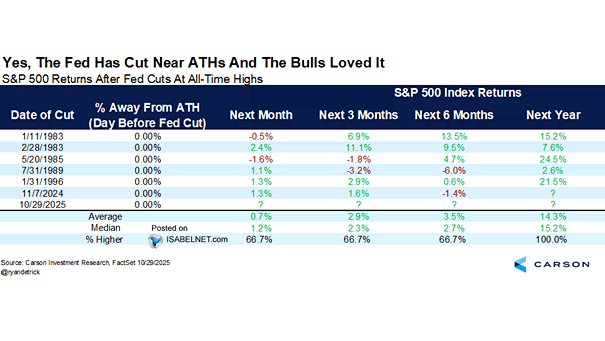

S&P 500 Returns After Fed Cuts At All-Time Highs

S&P 500 Returns After Fed Cuts At All-Time Highs Bulls are smiling for good reason: Every time since 1983, rate cuts with the S&P 500 at record highs have been a winning formula — stocks have risen a median 15.2% over the next 12 months. Image: Carson Investment Research