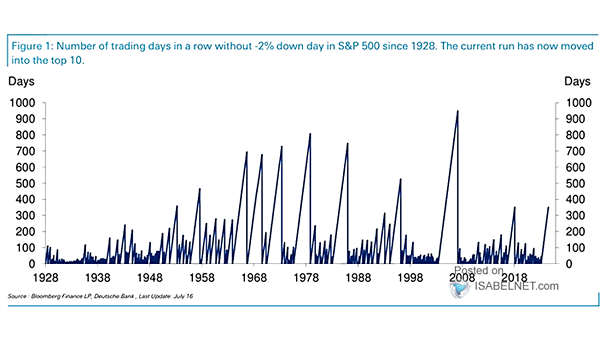

Consecutive Trading Days Without a 2% Drop in the S&P 500

Consecutive Trading Days Without a 2% Drop in the S&P 500 While the S&P 500’s 108-session run without a 2% drop is striking, history offers several precedents of calm periods that were just as long—or even longer. Image: Bloomberg