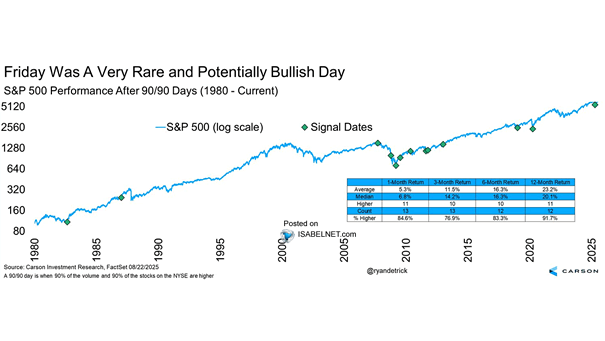

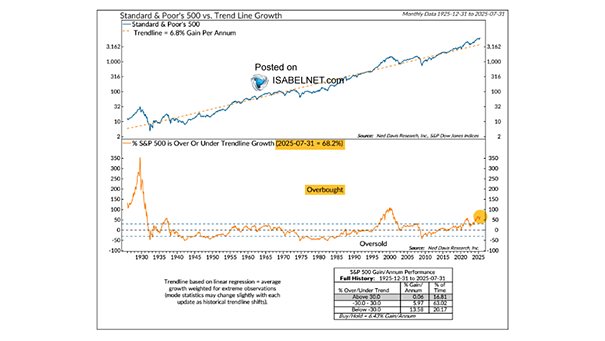

S&P 500 Performance After 90-90 Days

S&P 500 Performance After 90-90 Days The NYSE “90/90 day” on Friday—when 90% of volume and stocks rose—is rare and bullish. Since 1980, such days often precede strong market gains, with the S&P 500 rising over 90% of the time a year later, averaging 23% gains.