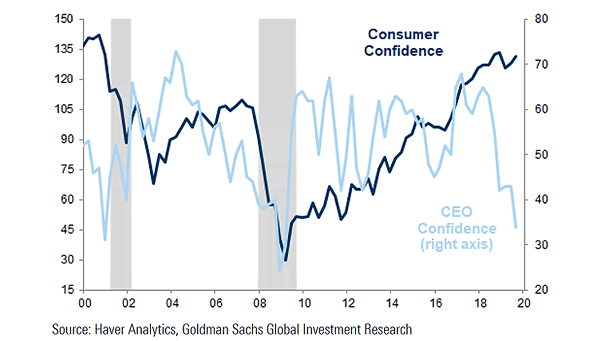

U.S. Consumer Confidence and CEO Confidence

U.S. Consumer Confidence and CEO Confidence The trade war keeps weighing on CEO confidence, which is near record lows, while consumer confidence has remained relatively strong. Image: Goldman Sachs Global Investment Research