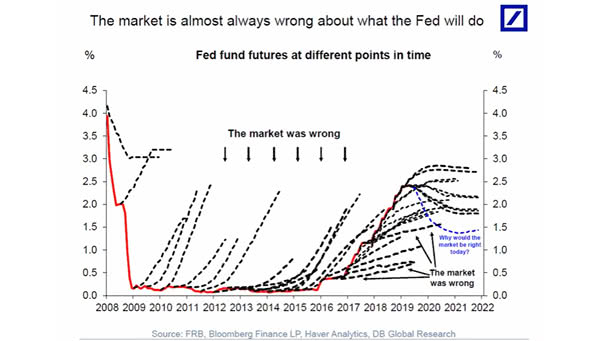

The Market is Almost Wrong about What the Fed Will Do

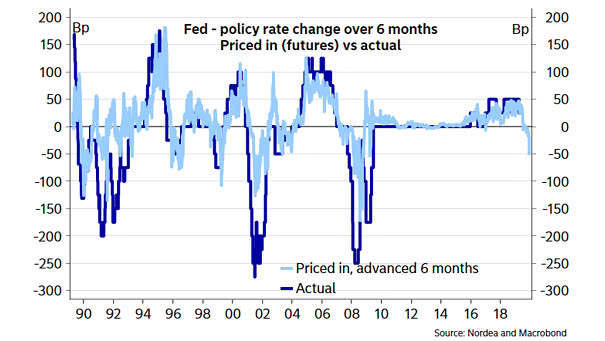

The Market is Almost Wrong about What the Fed Will Do Actually, the Fed decides when to raise rates. But the market decides when to cut rates: “Markets have accurately priced in cuts before easing cycles begin.” Keep in mind that rate cut expectations are highly predictive six months in advance. You may also like “Fed Policy…