Has the United States Ever Imported a Recession from a Single Foreign Country?

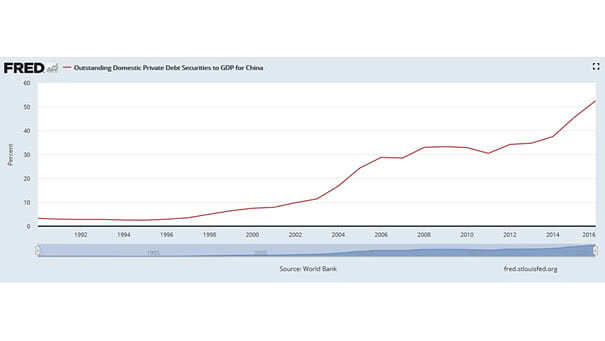

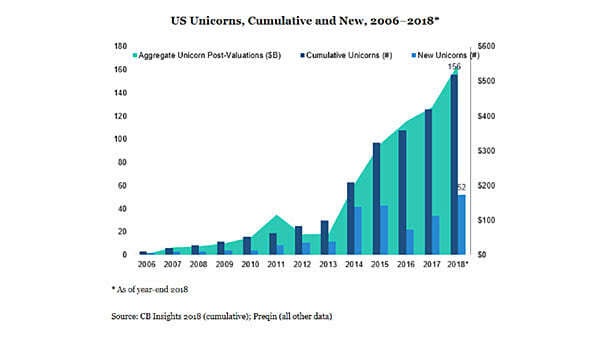

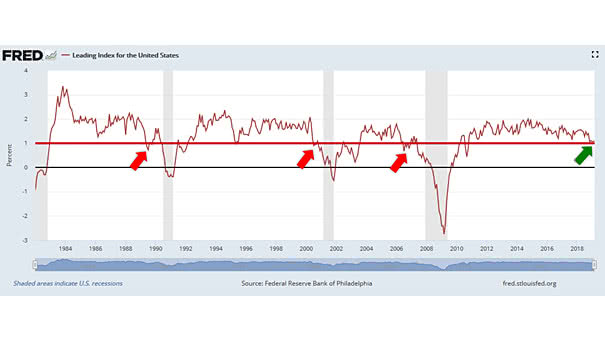

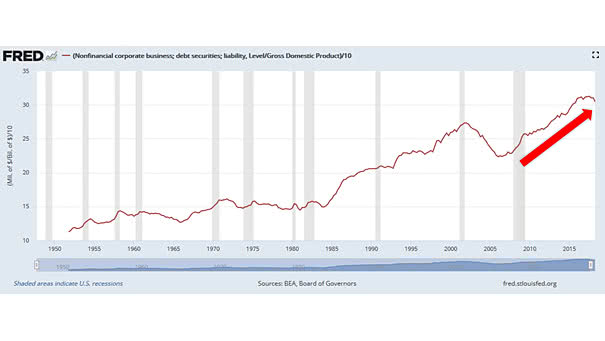

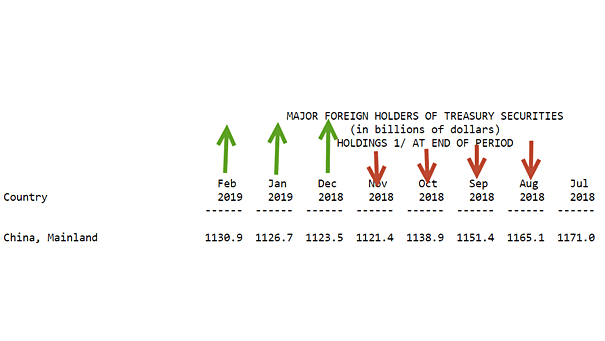

Has the United States Ever Imported a Recession from a Single Foreign Country? The biggest U.S. trade partners are: China, Canada, Mexico, Japan, Germany, South Korea, United Kingdom and France. So far, the US has never imported a recession from a single foreign country. A Chinese recession would be bad for the U.S. and the…