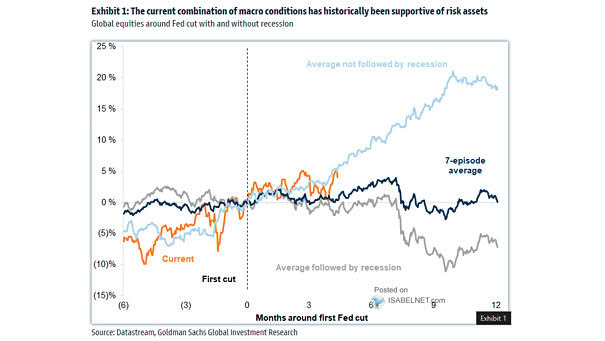

Global Equities Around Fed Cut With And Without Recession

Global Equities Around Fed Cut With And Without Recession Strong performance in global equities is common after the Fed’s initial rate cut, particularly when the economy remains recession-free for the subsequent 12 months. Image: Goldman Sachs Global Investment Research