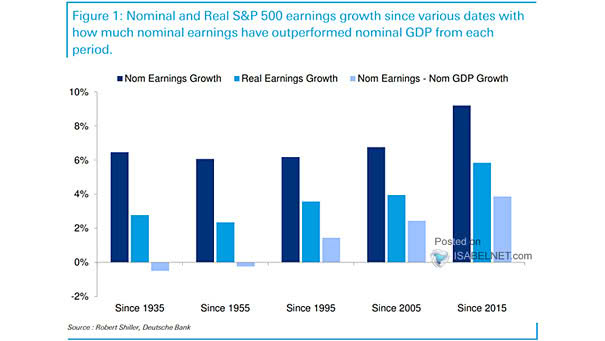

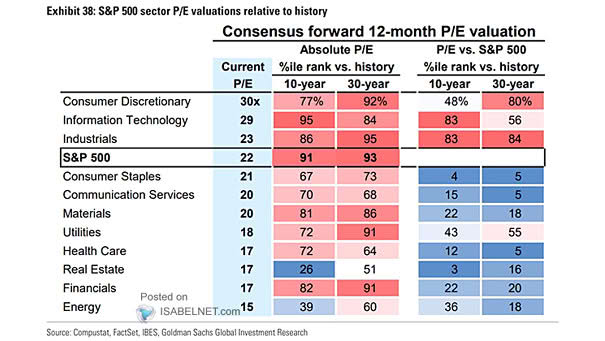

Nominal S&P 500 Earnings Growth – Nominal GDP Growth

Nominal S&P 500 Earnings Growth – Nominal GDP Growth The rapid acceleration of U.S. corporate earnings growth over the past three decades, which has outpaced the broader U.S. economy, is a key factor behind today’s…