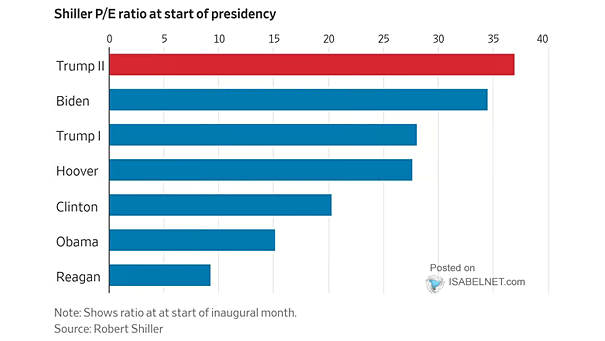

S&P 500 Valuation – Shiller P/E Ratio at the Start of Presidency

S&P 500 Valuation – Shiller’s Cyclically-Adjusted Price-To-Earnings (CAPE) Ratio With the Shiller P/E ratio indicating an unusually high valuation for the U.S. stock market compared to the start of previous presidential terms, investors may need…