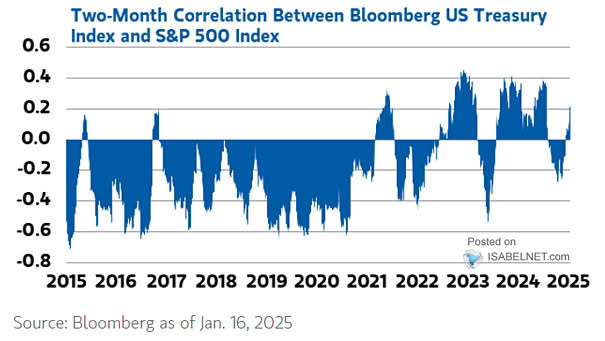

Two-Month Correlation Between Bloomberg U.S. Treasury Index and S&P 500 Index

Two-Month Correlation Between Bloomberg U.S. Treasury Index and S&P 500 Index The current positive correlation between stocks and bonds emphasizes the need for investors to diversify beyond traditional assets and adopt more sophisticated risk management…