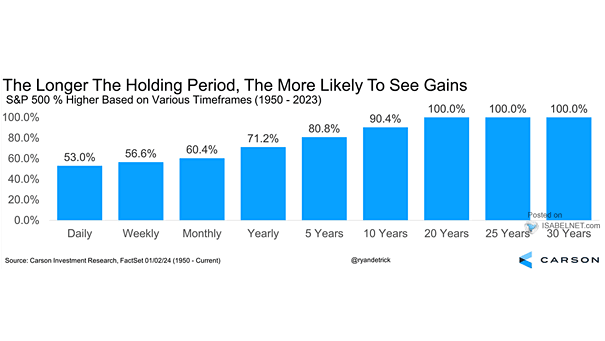

S&P 500 Index Returns Based on Various Timeframes

S&P 500 Index Returns Based on Various Timeframes Investors who hold positions in the S&P 500 for longer periods are more likely to achieve profitable returns and can better navigate the inherent volatility of the…