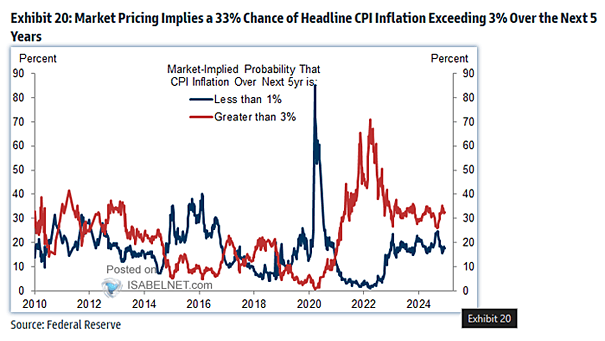

Market-Implied Probability of U.S. CPI Inflation Over the Next 5 Years

Market-Implied Probability of U.S. CPI Inflation Over the Next 5 Years Market pricing indicates a substantial likelihood that future U.S. headline CPI inflation rates will exceed 3%, with a 33% probability over the next five…