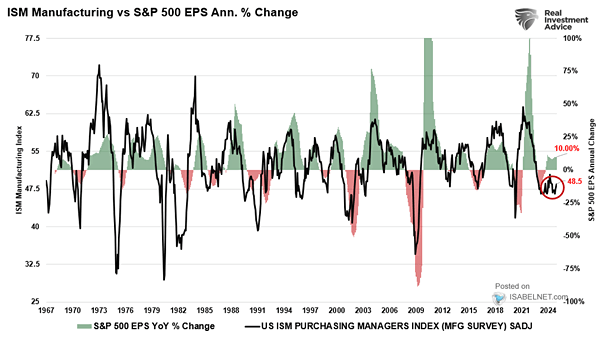

U.S. ISM Manufacturing Index vs. S&P 500 EPS Annual % Change

U.S. ISM Manufacturing Index vs. S&P 500 EPS Annual % Change With the ISM Manufacturing Index still in contraction territory and strongly correlated with S&P 500 earnings growth, questions arise about the resilience of corporate…