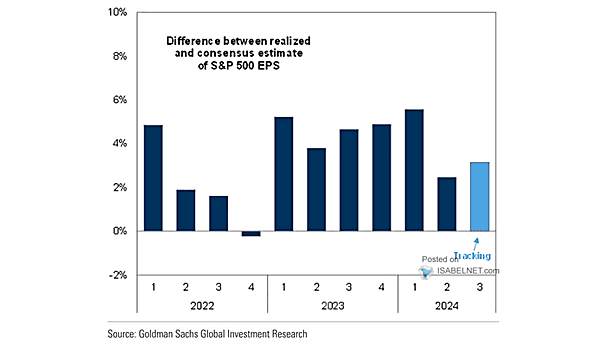

Difference Between Realized and Consensus Estimate of S&P 500 EPS

Difference Between Realized and Consensus Estimate of S&P 500 EPS While S&P 500 companies continue to beat EPS estimates, indicating underlying strength, recent data suggests this trend is moderating compared to previous quarters Image: Goldman…