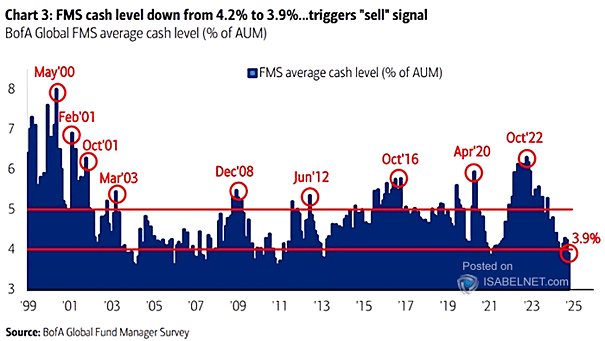

FMS Average Cash Balance

FMS Average Cash Balance The FMS cash level’s recent decline to 3.9% has generated a contrarian sell signal for global equities. Historically, these signals often precede market corrections, prompting investors to reassess their strategies. Image:…