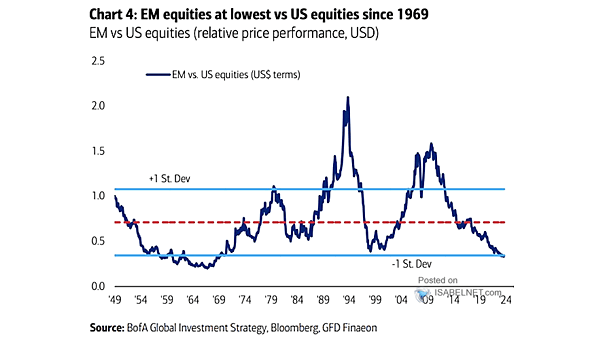

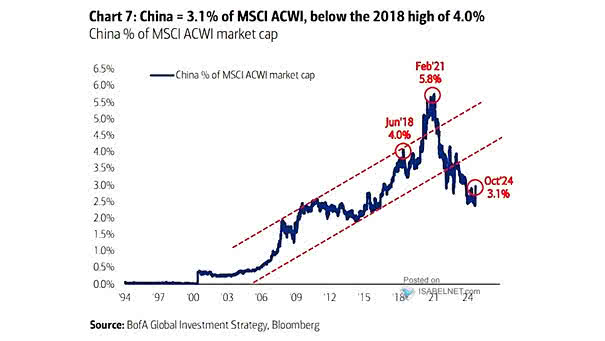

Performance – Price Ratio of Emerging Markets to U.S. Equities

Performance – Price Ratio of Emerging Markets to U.S. Equities Since the global financial crisis, emerging market equities have continuously underperformed U.S. equities, leading to the current situation where the ratio between the two is…