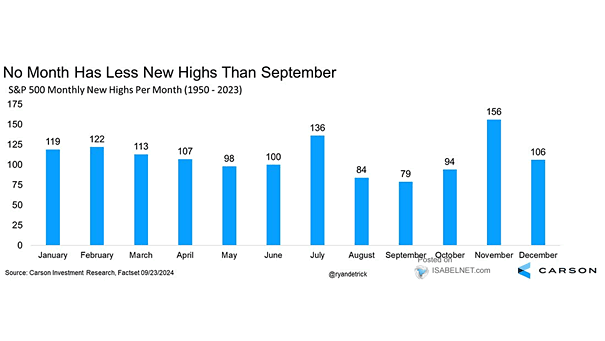

S&P 500 Monthly New Highs per Month

S&P 500 Monthly New Highs per Month Since 1950, the S&P 500 has achieved 1,314 new all-time highs, highlighting its ability to rebound from market declines and continue its growth trajectory. Such growth periods often…