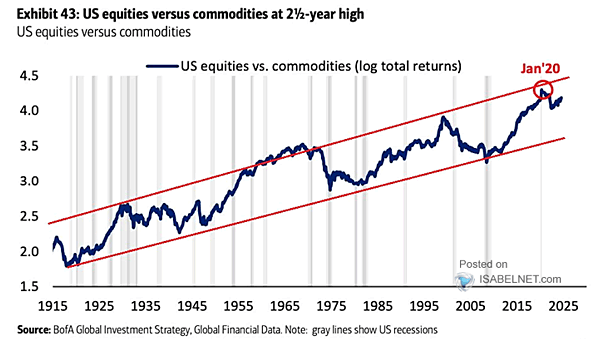

Returns – U.S. Equities vs. Commodities

Returns – U.S. Equities vs. Commodities While commodities can serve as a hedge in certain market conditions, U.S. equities are likely to continue outperforming them over the long term due to their lower volatility, more…