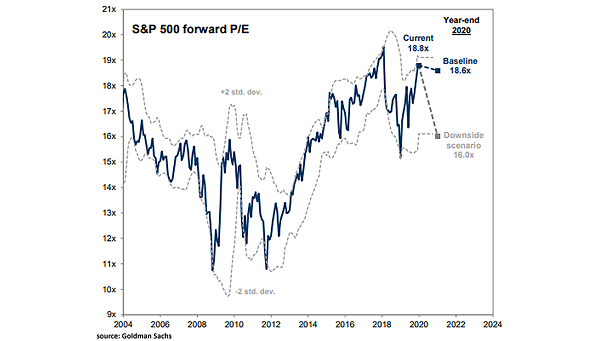

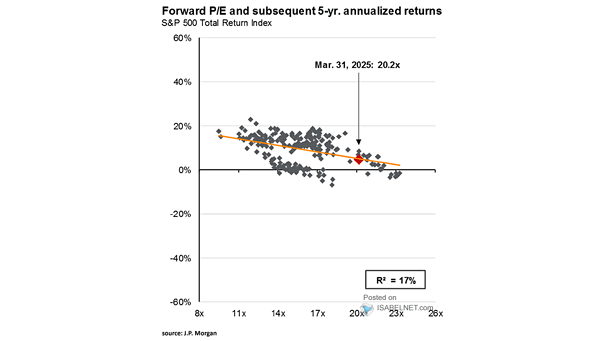

Valuation – Software Forward P/E

Valuation – Software Forward P/E Software valuations have come under heavy pressure, with the forward P/E multiple sliding to 20 times, a level investors haven’t seen since 2014. Image: Goldman Sachs Global Investment Research