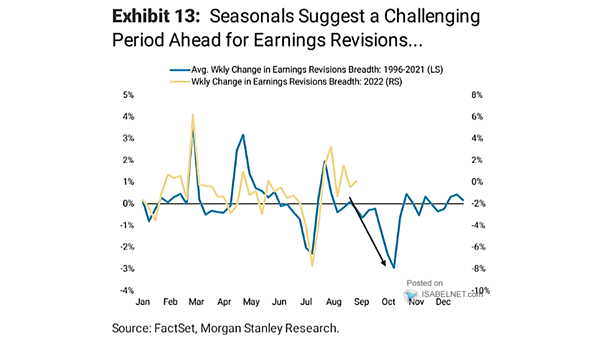

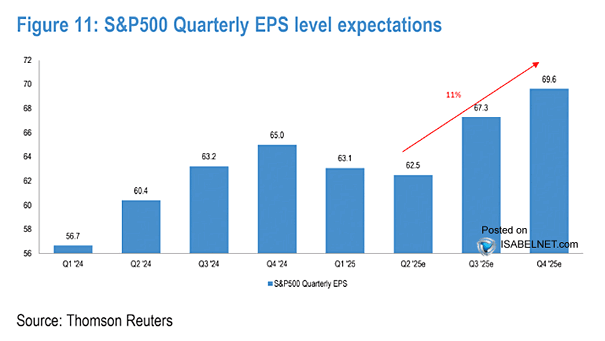

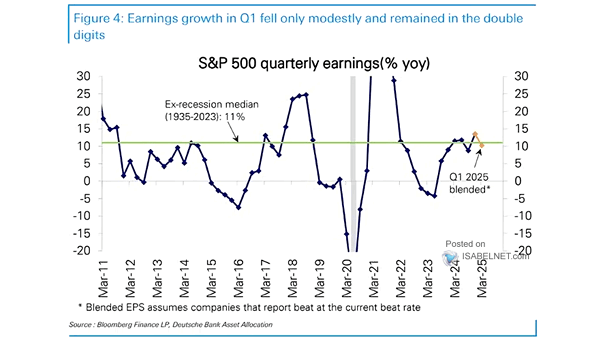

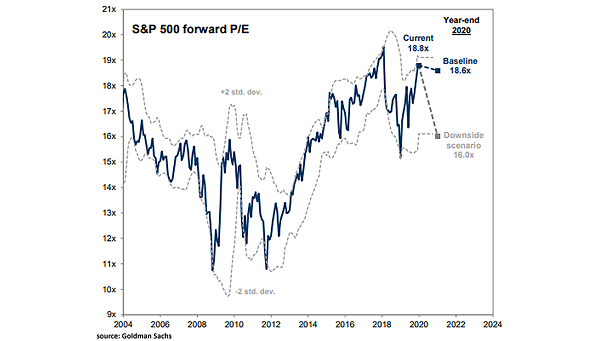

S&P 500 Earnings Revision Breadth

S&P 500 Earnings Revision Breadth The relationship isn’t perfect, but S&P 500 EPS revision breadth has often led market moves, showing a strong historical link with the index’s six‑month trailing returns. Image: Goldman Sachs Global…