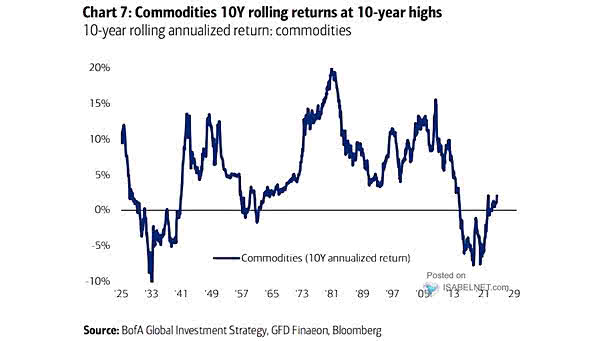

Commodities Rolling 10-Year Annualized Returns

Commodities Rolling 10-Year Annualized Returns Historical trends suggest that commodity bull markets have the potential to last for extended periods, often spanning multiple years. Image: BofA Global Investment Strategy