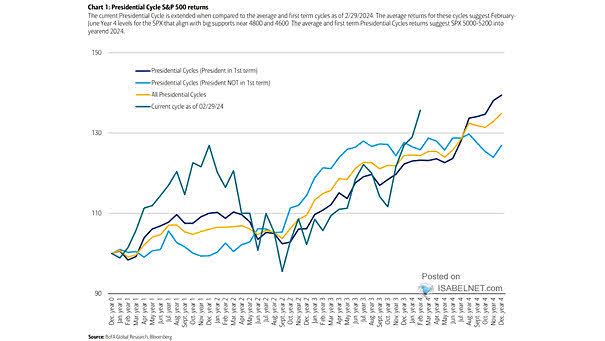

S&P 500 Returns – The 4-Year Presidential Cycle

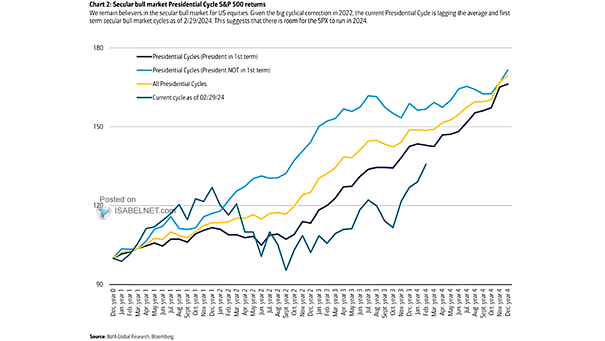

S&P 500 Returns – The 4-Year Presidential Cycle The current presidential cycle for the S&P 500 is extended when compared to both the average and first term cycles, highlighting the market’s unique dynamics and complexity.…