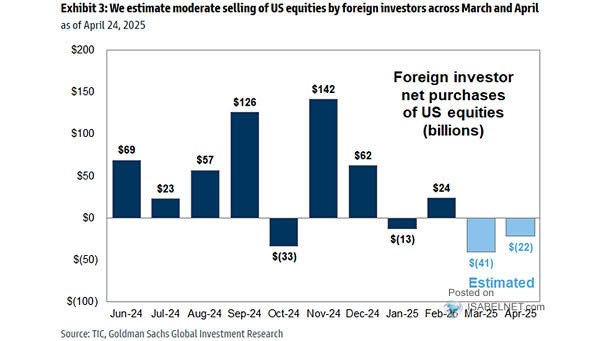

Foreign Investor Net Purchases of U.S. Equities

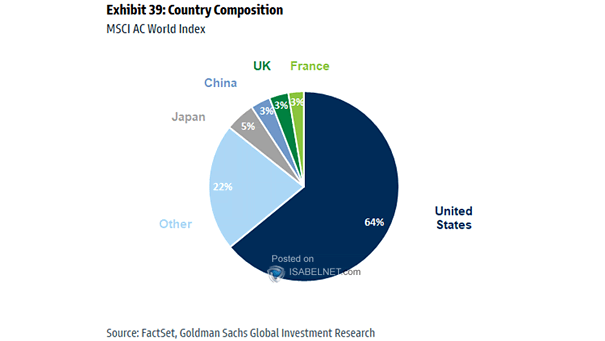

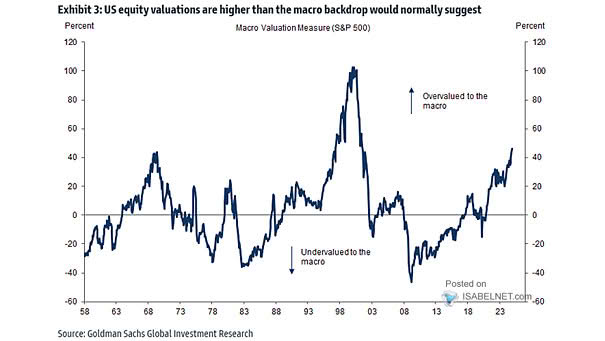

Foreign Investors Equity Allocation Percentile vs. History In 2025, foreign investors substantially increased their holdings of U.S. equities, reaching record levels despite stretched valuations, a weakening dollar and better returns abroad. Image: Goldman Sachs Global…