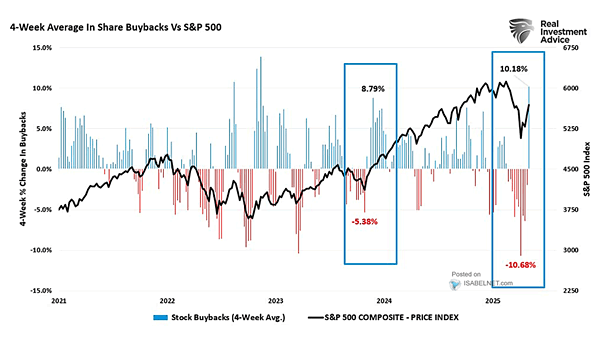

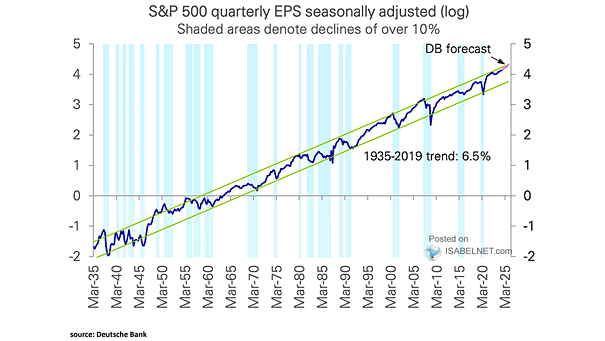

S&P 500 Buybacks vs. S&P 500 Composite 12-Month Trailing EPS

S&P 500 Buybacks vs. S&P 500 Composite 12-Month Trailing EPS Corporate buybacks and earnings growth have risen hand in hand. Much of that growth, though, reflects companies lifting their own share prices. With valuations stretched,…