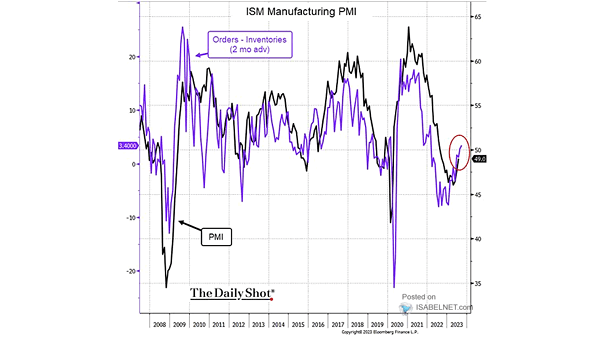

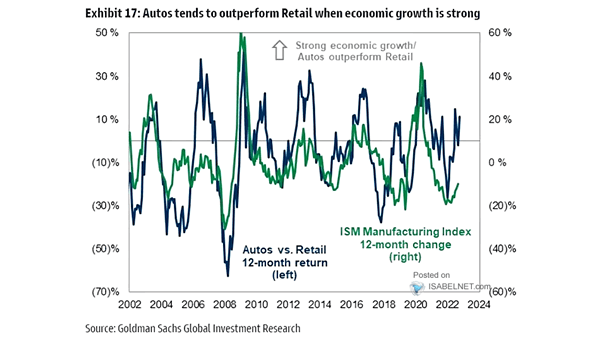

ISM Manufacturing PMI vs. ISM New Orders – Inventories

ISM Manufacturing PMI vs. ISM New Orders – Inventories The U.S. ISM New Orders less Inventories spread continues to suggest a higher ISM Manufacturing PMI. This correlation points towards a positive outlook for the manufacturing…